Smartphone-based tools for personal finance management

Introduction

In this digital age, smartphones have become an integral part of our daily lives, assisting us in various aspects including personal finance management. With the advancements in technology, numerous smartphone applications have been developed to help individuals easily track and manage their finances efficiently. In this article, we will explore some of the top smartphone-based tools that can assist in personal finance management.

1. Budgeting Apps

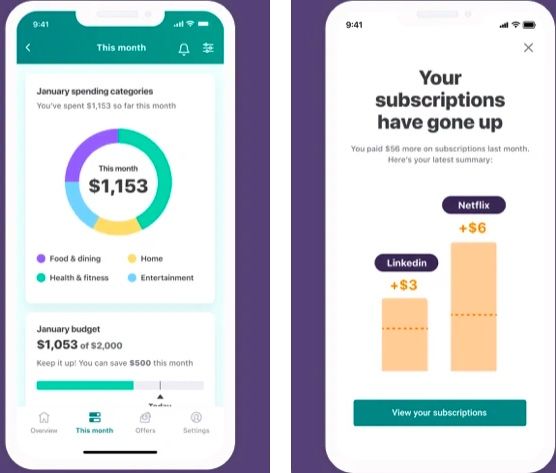

Budgeting Apps are essential tools for managing personal finances effectively. These apps allow users to set budgets, track expenses, and monitor their spending habits. Popular budgeting apps like Mint, You Need a Budget (YNAB), and EveryDollar provide users with a comprehensive overview of their finances, offering features such as bill reminders, goal setting, and progress tracking towards financial objectives.

2. Expense Tracking Apps

Expense tracking apps help individuals keep a close eye on their daily expenditures by categorizing and organizing expenses. These apps often offer convenient features such as scanning and digitizing receipts, automatically logging transactions, and generating detailed expense reports. With apps like Expensify, Wally, and Spendee, users can effortlessly track their spending patterns and identify areas where they can cut back.

3. Investment Apps

Smartphone-based investment apps have made investing accessible to the masses. These apps allow individuals to start investing with minimal capital, providing features like portfolio building, real-time market data, and customizable alerts. With Robinhood, Acorns, and Betterment, users can easily manage their investment portfolios and make informed decisions while on the go.

4. Bill Payment Apps

Bill payment apps streamline the often tedious process of paying bills. These apps offer features such as bill reminders, automatic payment options, and expense categorization. With apps like Simpl, BillPayCheck, and Mvelopes, users can conveniently manage all their bills in one place, ensuring that payments are made on time, avoiding late fees, and improving overall financial organization.

5. Money Saving Apps

Money saving apps provide individuals with tools and techniques to save money for various financial goals. These apps assist users in tracking their savings progress, offering budgeting features and rewards for meeting set milestones. Apps like Qapital, Digit, and Chime utilize innovative methods such as automatic savings transfers and round-up savings, making it effortless to save money for emergencies or long-term objectives.

Conclusion

Smartphone-based tools have revolutionized the way individuals manage their personal finances. From budgeting and expense tracking to investment management and bill payment, there is an array of powerful apps available to assist individuals in improving their financial well-being. With these tools at their fingertips, individuals can easily stay on top of their finances, make smart financial choices, and work towards achieving their financial goals.